Am I talking to a human or are computers getting this good?

Interview with Salóme Rúnarsdóttir, Product Owner of Chatbot Fróði at Íslandsbanki

Íslandsbanki is one of the most advanced banks in Island and has been pioneering forward-looking initiatives that push the envelope in creating a seamless and cohesive banking experience for its customers. It offers a comprehensive range of services, including corporate banking, asset management and retail banking. Íslandsbanki automated 50% of all chat traffic through its virtual agent Fróði to deliver a scalable customer service that has garnered 85% approval rating from its users, according to customer feedback. At the invitation of 2Mobile, integrators of AI-powered technology solutions, Salome recently visited Slovenia, a country she is passionate about and whose boutique atmosphere reminds her of her home country.

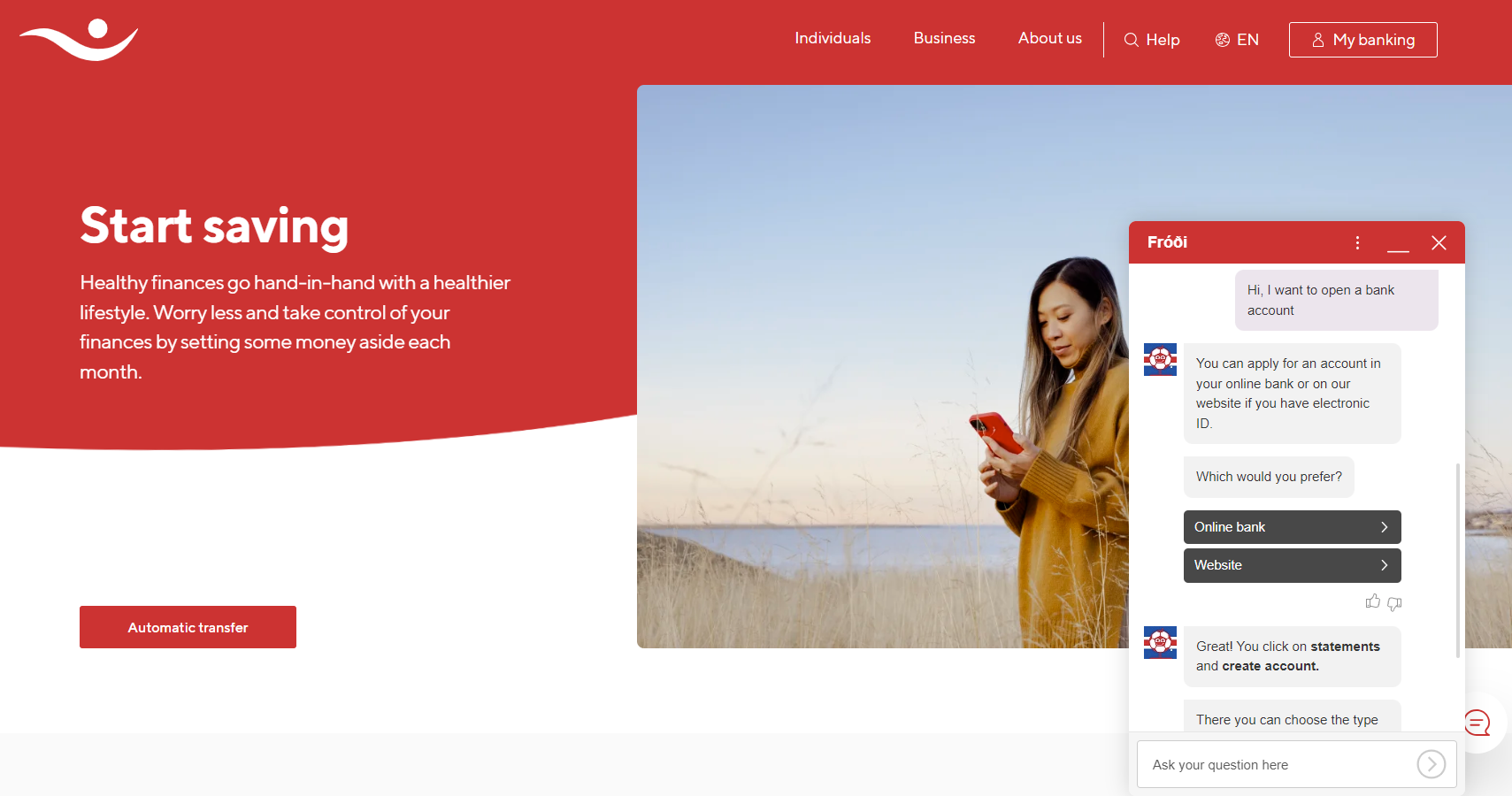

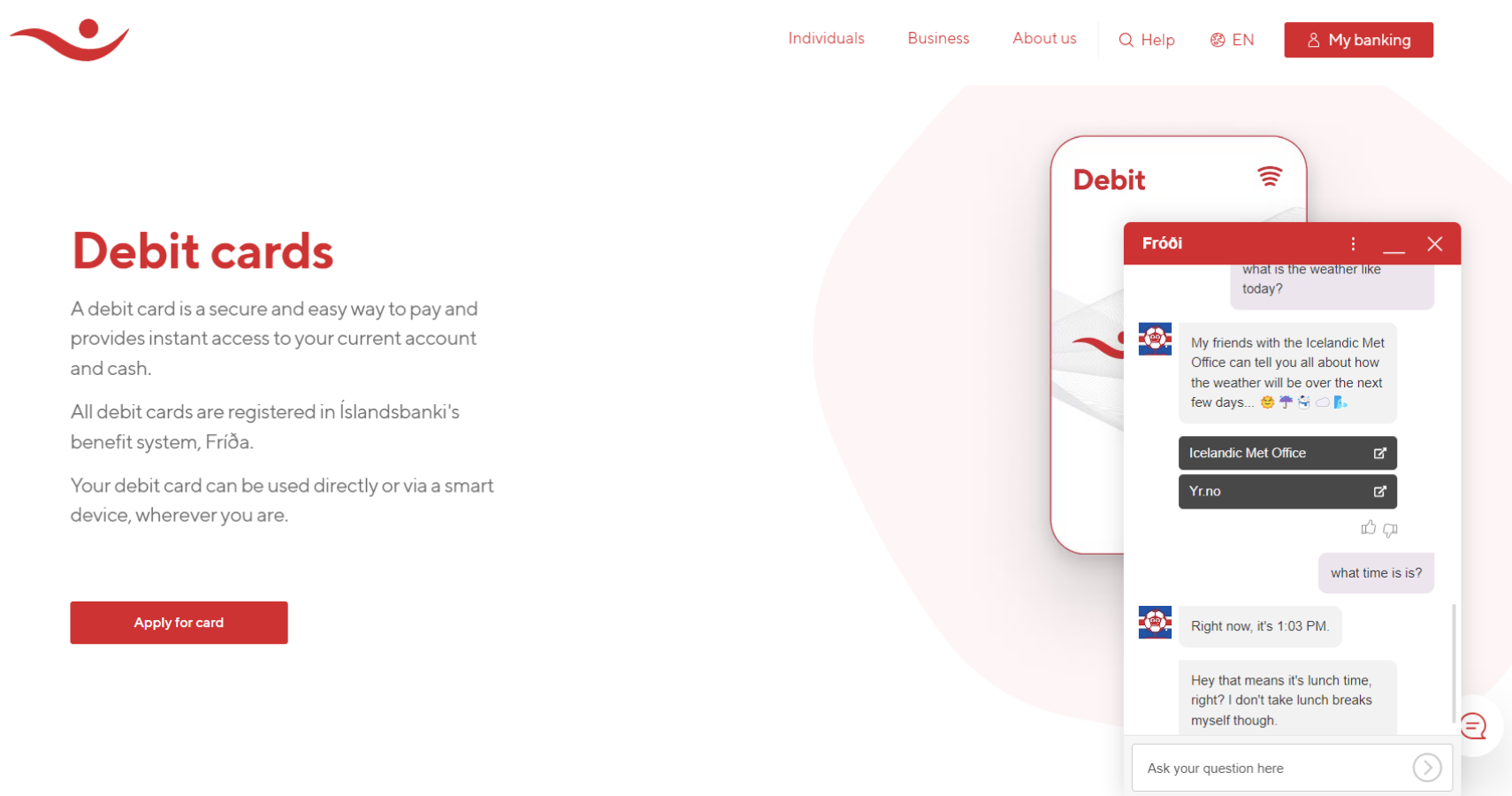

In this interview with Salóme Rúnarsdóttir , Product Owner at Íslandsbanki, we talked about how AI-powered virtual agent named Fróði built on the boost.ai platform helped the bank embrace the potential of scalable automation. It boosted customer self-service and helped create more dynamic customer experiences. Fróði was developed for Íslandsbanki by Boost.ai, a leading provider of technology for conversational commerce services, which was recognised by Gartner as a challenger in its Magic Quadrant for Conversational Artificial Intelligence Solutions.

What prompted Íslandsbanki to start using conversational AI, and what specific objectives or goals were set for its implementation?

For a while now, we’ve been on the journey of digitizing our solutions and processes to make it easier for our customers to use our services where and when they want and on their terms. One of the objectives was to make our banking service personalised and available 24/7. That’s exactly what happened. Immediately after launching Fróði, we could see that our customers liked chatting with him and treating him like a human. For example, “Thanks” and “No thanks” are in top 10 answers of intent traffic. Of course, we also wanted to reduce our chat traffic to give our advisors more time to engage in deeper conversations with our customers and provide excellence service.

Who were the key stakeholders involved in initiating the Fróði project, and what roles did they play in shaping its direction and strategy?

The core implementation team comprised two executives in personal banking, one of them leading the contact centre and the other leading innovation. We also engaged two contact centre employees with extensive knowledge of the bank and its services as well as a marketing specialist. Having executives in our team streamlined the decision-making process. The employees of contact centre mentioned above took on the role of AI trainers. They worked with marketing to shape Fróði’s character.

When did the Fróði project officially start, and what were the initial challenges or obstacles faced during its inception and early development stages?

We started the implementation phase in the fall of 2019 and Fróði’s first shift was 20 weeks later. Prior to that we conducted a proof-of-concept workshop with boost.ai’s and their partner in Iceland. In just two days, we developed a basic version of a chatbot. The outcome was impressive and helped us get internal buy-in. The implementation phase ran smoothly, requiring minimal IT involvement and primarily being managed by a few customer service members.

The biggest challenge was to bring a chatbot to a community that didn’t have very positive experiences with this technology. I wasn’t a part of the implementation team but joined the team about a year later. To be completely honest, I didn’t like the idea of bringing a chatbot to the bank. I thought that it would greatly affect the personal service the bank was known for. In my past experience chatbots struggled to understand me and asked me to rephrase the question. And it didn’t matter how many times I rephrased it – they just never understood me. So, I held up trying out Fróði. However, when I did, it surprised me a lot, not only by how well he understood me and how good and natural his answers were, but also with a great conversation flow. It shouldn’t come as a surprise that Fróði was a huge success. We kept getting positive feedback like “Am I talking to a human or are computers getting so good?”

How did the Fróði virtual agent progress over time, and what were the major milestones or achievements along the way?

Fróði had a strong start and his satisfaction ratings were good from day one. Initially, our customers could choose to either talk to Fróði or one of our human advisors. Approximately three months later, we decided to make Fróði the primary point of contact in the bank’s webchat. At the beginning of each conversation Fróði informs customers that he can transfer the conversation to a human advisor at any time. That was a good decision and we saw key statistics like satisfaction rate and resolution rate rise steadily over a few months to reach the levels we see today – approximately 85% satisfaction rate and 96% resolution rate. That indicates that Fróði is good at answering questions which I believe is a huge factor in generating positive feedbacks. For the first two years, he was only able to answer general questions about the bank and its services and products. Over the past several years, he has been answering around 50% of all chats. We recently embarked on the journey of making Fróði even smarter by integrating him with API’s. Over the coming months, we will see this percentage rise in the next months and we will automate more processes and alleviate more workload from our advisors.

What are the key outcomes and benefits of the Fróði virtual agent today?

Firstly, Fróði is significantly easing the workload on our contact centre by handling common and repetitive questions that advisors used to address in chat. That gives our advisors more time to redirect their efforts to more demanding and complicated matters that leverage their skills and experience. He also reduced the chat queue waiting time to zero second, saving customers and employees valuable time. Of course, to have a virtual agent available around the clock that our customers find useful, funny, and clever is a big factor in delivering excellent service. One of the outcomes that surprised me was how much people like to chat to Fróði about general topic completely unrelated to banking. Thanks to our great AI trainers, he can answer a lot of general questions too. The real benefits are expected to unfold later when we utilize more features in boost.ai’s solution.

Can you maybe share some plans for the future? How do you see the use of AI-powered services in Íslandsbanki in the future?

Sure. I believe that Fróði has much more to give. We have started the journey of automating more processes and services with Fróði. We would like him to be able to answer more personalized questions and handle simple tasks related to our products and services, further alleviating the workload on our contact centre. Over the past few months, we have been focusing on Generative AI and started implementing it into our solutions to help us provide our customers with excellent service. As we use the LLM feature in boost.ai’s system and continue our API connection journey we will create a first-class virtual agent that will be there for our customers 24/7. It would also benefit our customers to be able to have voice conversations with Fróði and make him available to all our accessibility groups. With that all in place, we see Fróði making significant contributions to the bank’s vision of creating future value with excellence service.